Real Estate Tax Incentives and Economic Development

Federal, state, and local laws provide significant incentives for development, redevelopment, and expansion projects. Having assisted clients with projects in nearly all 50 states, we have a deep understanding of the types of incentives available, the processes to secure and maximize those incentives, the complex issues arising from different programs, and compliance once a project is complete. Don’t embark on your next development project without talking to our team first to see if you qualify for these incentives.

Dykema’s team incorporates tax, real estate, corporate, finance, and government professionals to help companies large and small maximize opportunity and minimize overall project costs through federal, state, and local economic development and tax incentive programs. Together, this team identifies appropriate programs, assesses incentive valuation, leads the application and negotiation processes, and structures transactions that will result in the best possible outcomes for our clients.

As digital infrastructure explodes, data centers are becoming CRE’s most in-demand asset class.…

Laura Weingartner Earns 2024 Lawyers in Real Estate Award From Connect CRE

Dykema, a leading national law firm, proudly announces that Laura Weingartner was selected to…

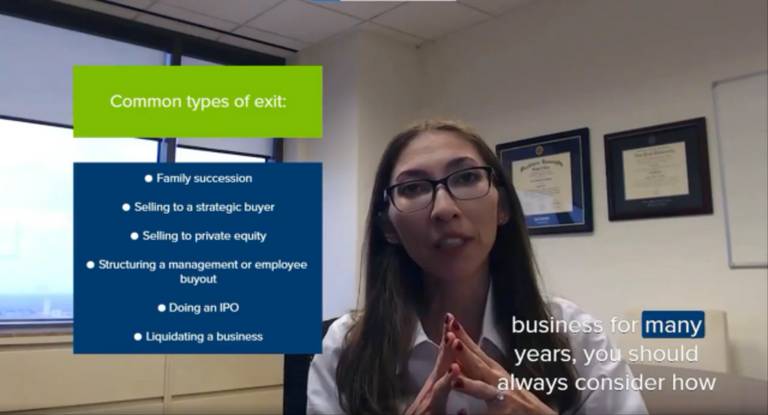

It’s never too early for business owners to start preparing an exit strategy. In fact, it’s one of…