Nonprofits and Tax-Exempt Organizations

Unlike their for-profit counterparts, nonprofits and tax-exempt organizations must overcome regulatory hurdles while also facing a higher level of state and federal government scrutiny around their formation and operations.

Our clients include charitable organizations, private foundations, and community and economic development groups that include:

- education, healthcare, research, and religious organizations

- trade and professional associations

- social welfare and political organizations

- advocacy groups

- rural electric cooperatives

The services we provide include corporate, tax, compliance, regulatory, employment, licensing, government relations, real estate, litigation, and pensions and benefits.

47 Dykema Attorneys Named to 2024 Michigan Super Lawyers and Rising Stars Lists

Dykema, a leading national law firm, announced today that 26 of its attorneys from the firm’s…

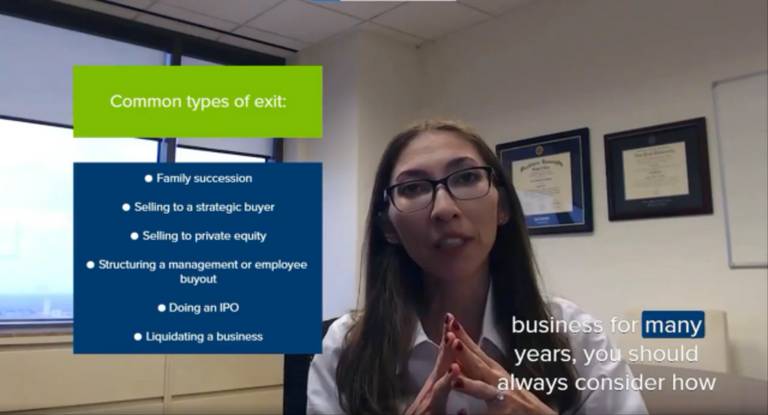

It’s never too early for business owners to start preparing an exit strategy. In fact, it’s one of…

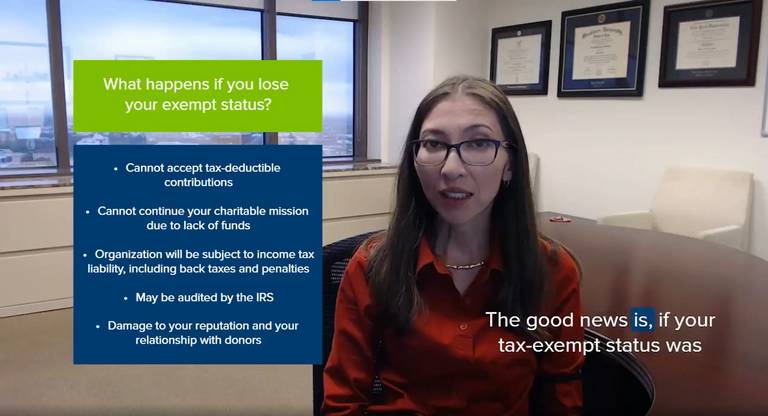

How to lose your tax-exempt status without trying and what you can do about it. In this One Minute…